ATFUNDED

Your Trusted

Prop Trading FIRM

Earn as you trade. Grow without limits and build the trading career you’ve always wanted!

ATFUNDED PRO

Inspired by the best. Reimagined for CFDs.

ATFunded Pro blends the structure of top-tier futures prop firms with the flexibility of CFD trading, delivering a faster, smarter path to funding.

One streamlined challenge. No delays. Built for serious traders ready to grow.

ATFUNDED CHALLENGE

The classic 2-phase challenge — refined.

ATFunded Challenge is our proven two-phase model, designed to test your skills and reward consistent performance.

A structured path with clear milestones — built for traders who value precision and progress.

Your Best Prop Firm Challenge Choice

Backed by a leading broker

ATFunded is supported by ATFX, a globally recognized broker known for its reliability and advanced trading technology

Profit Beyond Your Trades

Turn your skills into income. Reach the ATFunded Plus+ status and share your trades on the ATFX copy-trading platform, earning extra while others follow your strategy.

Your trading career in one place

ATFunded supports you at every phase, offering everything you need—from beginner tools to advanced resources—to grow and succeed in one convenient platform

Start your trading career with the funded program that fits you best.

Whether you choose the 2-Phase Challenge Program or the Pro Program, both are built to help you achieve long-term growth.

Target:

Phase 1:x | Funded:x

Daily Drawdown:

Phase 1:x | Funded:x

Max Drawdown:

Phase 1:x | Funded:x

Max Allocation:

150k

Activation Fee $

See All Features for Pro Program

| Account Size | Max Lot FX | Max Lot Metals & Indices | MLL ($) | Activation Fee ($) |

|---|---|---|---|---|

| 10k | 1 | 0.5 | 500 | 25 |

| 50k | 5 | 2.5 | 2000 | 149 |

| 100k | 10 | 5 | 3000 | 149 |

| 150k | 15 | 5 | 4500 | 149 |

| Rule | Phase 1 | Funded |

|---|---|---|

| Target | 6% | X |

| The profit target is established at 6% of the initial balance of the account in the assessment stage. In the funded stage, there is no specific profit target. | ||

| Daily Drawdown | None | |

| ATFunded Pro program does not have a daily drawdown limit. | ||

| Max Drawdown | Trailing | |

|

Accounts in the ATFunded Pro program are subject to a Maximum Loss Limit, also known as trailing drawdown, in both stages. The allowed loss depends on your account size and is calculated based on the account’s starting equity (balance plus unrealized profits/losses) at the beginning of each day (00:00 server time). Once the limit reaches the initial account balance, it stays at that level for the remainder of the stage, allowing any additional profits to act as a buffer. The limit will never decrease, even if your equity is lower at the start of a day. The limit for each account size is as follows:

The formulas to calculate your limit are as follows: If your equity is below the initial account size: If your equity is above the initial account size: If your equity goes above Account Size by more than the initial allowed loss, the limit will stay at the initial account size. |

||

| News Allowed | No | |

| Trading during news events is not permitted. This guideline helps maintain a controlled trading environment, allowing traders to focus on strategies that are less affected by market volatility during significant news releases. | ||

| EAs | Yes | |

| The use of Expert Advisors (EAs) is permitted, allowing traders to automate their strategies. | ||

| Consistency | 30% | |

| Traders are required to follow our Consistency Rule during both stages of the program. The consistency threshold is set at 30%. | ||

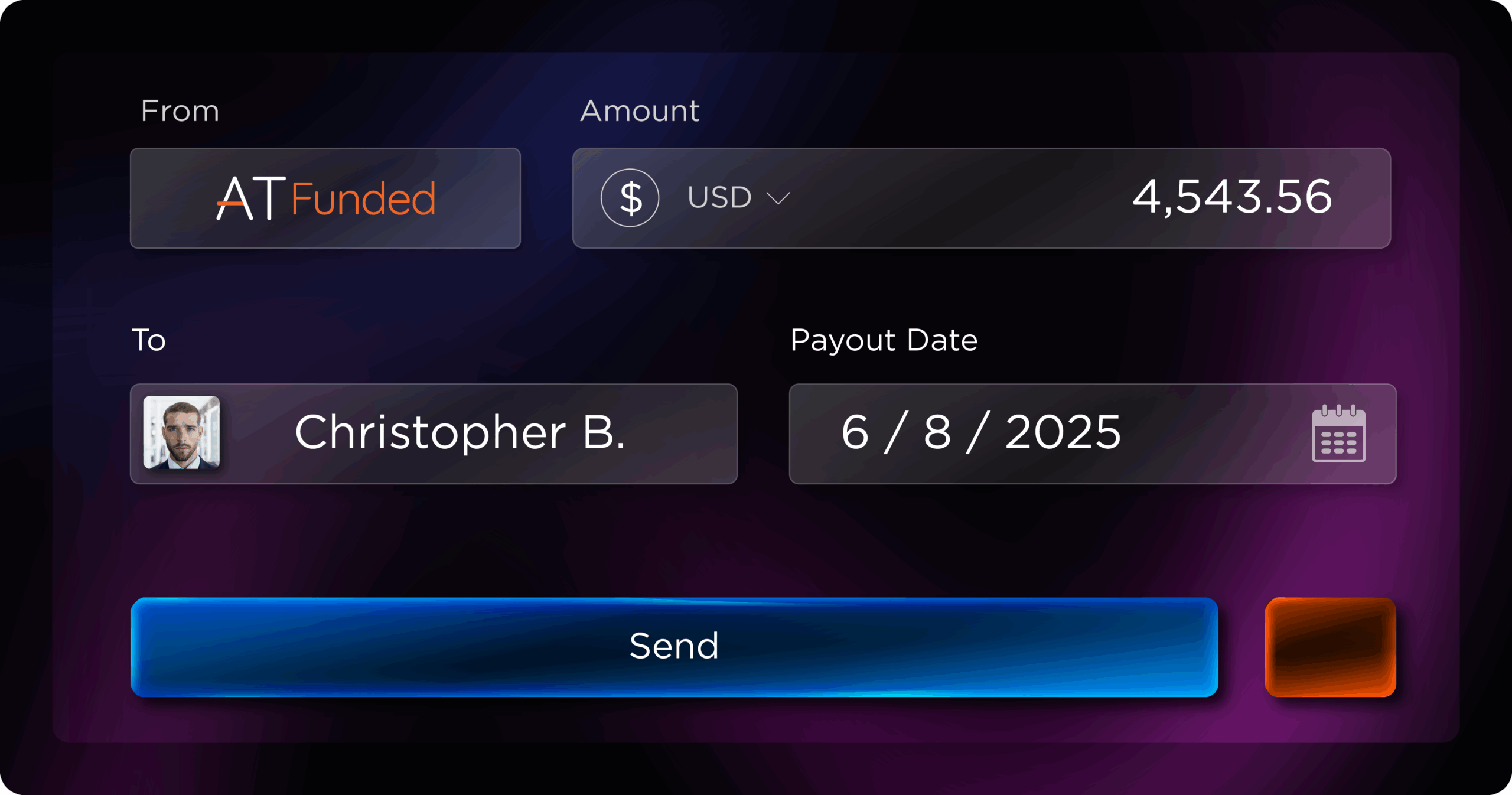

| Pay Period | X | Bi-Weekly |

| The pay period refers to the timeframe in which traders can receive their earnings from ATFunded. Payouts are processed on a bi-weekly basis, allowing traders to access their profits regularly while adhering to the program's requirements. | ||

| Profit Split | X | 50-80% |

| Traders get to choose how much profit to withdraw from the funded account. New funded accounts are allowed to withdraw up to 50% of profits as payout, with $5,000 being the maximum withdrawal amount per one payout. Starting from third payout, that limit is increased to 80%, and the $5,000 limit is removed. The minimum withdrawal amount is $125. | ||

| Leverage | 1:30 FX, 1:20 Indices & Metals, 1:10 Oil | |

| Leverage allows traders to control a larger position size with a smaller amount of capital. At ATFunded, traders can access a leverage of up to 1:30 for FX, 1:20 for Indices and Metals, 1:10 for Oil, enabling them to amplify their trading potential while managing their risk effectively. Accounts in the ATFunded Pro program are not allowed to trade cryptocurrency pairs. | ||

Target:

Phase 1:x | Phase2:x | Funded:x

Daily Drawdown:

Phase 1:x | Phase2:x | Funded:x

Max Drawdown:

Phase 1:x | Phase2:x | Funded:x

Max Allocation:

200k

See All Features for 2-Phase Challenge Program

| Phase 1 | Phase 2 | Funded | |

|---|---|---|---|

| Target | 8% | 5% | X |

| In the ATFunded Challenge, the profit targets are established at 8% of the initial balance for Phase 1 and 5% for Phase 2. These targets represent the total profits achieved from closed positions on your trading account, which you can reach at any time during the Trading Period. | |||

| Daily Drawdown | 4% | ||

| The Daily Drawdown limit in the ATFunded Challenge is set at 4% for all phases. This limit refers to the maximum allowable loss from your account balance in a single trading day, ensuring that risk management remains a key focus throughout your trading experience. | |||

| Overall Drawdown | 10% | ||

| The Overall Drawdown limit in the ATFunded Challenge is capped at 10% across all phases. This limit represents the maximum allowable loss from your initial account balance throughout the entire challenge, helping to safeguard your trading capital while you pursue your profit targets. | |||

| News allowed | No | ||

| In the ATFunded Challenge, trading during news events is not permitted. This guideline helps maintain a controlled trading environment, allowing traders to focus on strategies that are less affected by market volatility during significant news releases. | |||

| EAs | Yes | ||

| The use of Expert Advisors (EAs) is permitted, allowing traders to automate their strategies. | |||

| Min. Trading Days | 3 | 3 | X |

| A trading day is a day where the trader has made a profit of at least 0.5%. To advance to the next phase the minimum trading days requirement (3) must be met. | |||

| Min. Trades | X | X | 5 |

| Minimum trades is the number of trades required to be eligible for the first payout. A trade is any trade that is >80% of the largest trade. | |||

| Drawdown type | Balance Based | ||

| The trigger point for your daily drawdown is based on the balance at 00:00 each day. If equity or balance goes below that value the account will be breached. | |||

| Pay Period | X | X | Bi Weekly |

| The pay period refers to the timeframe in which traders can receive their earnings from ATFunded. Payouts are processed on a bi-weekly basis, allowing traders to access their profits regularly while adhering to the program's requirements. | |||

| Bonus | X | X | 3rd Payout |

| The bonus is an incentive provided to traders, amounting to 100% of the initial fee. This bonus is awarded upon receiving the third payout on a single account, rewarding traders for their continued success and commitment. | |||

| Profit Split | X | X | 80% |

| The profit split is the percentage of profits that traders retain after reaching their profit targets. At ATFunded, traders benefit from an impressive 80% profit split, allowing them to keep a significant portion of their earnings while working towards their financial goals. | |||

| Leverage | 1:30 FX, 1:20 Indices & Metals, 1:10 Oil, 1:2 Crypto | ||

| Leverage allows traders to control a larger position size with a smaller amount of capital. At ATFunded, traders can access a leverage of up to 1:30 for FX, 1:20 for Indices and Metals, 1:10 for Oil, and 1:2 for Crypto, enabling them to amplify their trading potential while managing their risk effectively. | |||

Don't Just Dream of Trading.

Start Practicing Today with a Free $10k Demo.

Our free demo account provides you with $10,000 in virtual capital to practice, refine your strategies, and experience real market conditions. Prove your skills, build your confidence, and take the first step towards becoming a funded trader.

Withdraw your profits with the following payment methods!

Seamless Fund Transfer for Traders

Maximize your trading potential with ATFunded! Choose to withdraw profits directly or transfer them to an ATFX brokerage account, allowing you to start trading with your earnings right away.

Stay up to date with our News and Blog Section

Learn More About ATFX

Visit ATFX to explore everything you need to know about ATFX, including our services, offerings, and trading opportunities.