Step 1: Scaling In & Scaling Out of Trades

Scaling in/out means adjusting your position size as the market moves in your favor or against you.

1. Scaling In (Adding to a Winning Trade)

If the trade moves in your favor, you can add to your position to maximize gains.

🔹 How to Do It on MT5:

- Open a second position in the same direction when price confirms momentum.

- Keep each new position smaller to reduce risk.

- Move stop-losses of previous trades to breakeven to protect capital.

📌 Example:

- Initial Buy: EUR/USD at 1.1000, 0.5 lots.

- Price moves to 1.1020, confirm uptrend → Add 0.3 lots.

- Price reaches 1.1040, confirm further strength → Add 0.2 lots.

- Stop-loss for first position moved to 1.1010 to lock in profits.

✅ Scaling in works best in strong trends and helps maximize profits while minimizing initial risk.

2. Scaling Out (Closing Part of a Trade to Secure Profit)

Instead of closing the full position at once, you can take partial profits as price moves in your favor.

🔹 How to Do It on MT5:

- In the Trade tab, right-click your open trade and select Modify or Close Order.

- Adjust the lot size to close only a portion of the trade.

- Keep the remaining position open to target higher profits.

📌 Example:

- Buy 1 lot at 1.1000 with a target of 1.1050.

- When price reaches 1.1030, close 50% of the trade (0.5 lots).

- Let the remaining 0.5 lots run to the final target.

✅ Scaling out locks in profits while keeping the trade running for more gains.

Step 2: Using Trailing Stop-Losses to Lock in Profits

A trailing stop-loss (TSL) automatically moves your stop-loss as price moves in your favor, helping to secure profits while letting winners run.

How It Works:

- If price moves X pips in profit, the stop-loss moves X pips higher (for buys) or lower (for sells).

- If price reverses by X pips, the trade closes automatically.

🔹 How to Set a Trailing Stop on MT5:

- Right-click your open trade in the Trade tab.

- Select Trailing Stop and choose the number of pips to trail (e.g., 10 pips).

- MT5 will automatically move your SL as price moves in your favor.

📌 Example:

- Buy at 1.1000 with a 20-pip trailing stop.

- Price moves to 1.1020, SL moves to 1.1000 (breakeven).

- Price moves to 1.1050, SL moves to 1.1030.

- If price drops to 1.1030, trade closes with 30 pips profit.

✅ Trailing stops protect profits without needing manual adjustments.

Step 3: Managing Active Trades on MT5

Once your trade is open, you can adjust SL, TP, and lot sizes to optimize performance.

1. Adjusting Stop-Loss & Take-Profit

🔹 How to Modify on MT5:

- Go to the Trade tab, right-click your trade → Modify Order.

- Change Stop-Loss (SL) and Take-Profit (TP) levels.

- Click Modify to save.

📌 Example:

- Initial TP: 1.1050, but price is struggling at 1.1035.

- Adjust TP down to 1.1030 to secure gains before a reversal.

✅ Be flexible—if market conditions change, adjust SL/TP accordingly.

2. Closing Trades in Stages

Instead of exiting all at once, close trades in parts.

🔹 How to Close Partial Trades on MT5:

- Right-click trade in Trade tab → Select Modify Order.

- Change Volume (lot size) to close only part of the trade.

📌 Example:

- Buy 1 lot at 1.1000 with TP at 1.1050.

- At 1.1025, close 0.5 lots for profit.

- Let the remaining 0.5 lots run to 1.1050.

✅ This method locks in profits while allowing for further gains.

Step 4: Common Trade Management Mistakes to Avoid

🚫 Moving Stop-Loss Against You – Never widen your SL to avoid a loss; accept small losses.

🚫 Closing Trades Too Early – Let profits run using trailing stops or scaling out.

🚫 Over-Scaling In (Too Many Additions) – Adding too many positions increases risk.

🚫 Ignoring Market Conditions – Adjust trade management based on volatility and trend strength.

How to Stay Disciplined:

✅ Stick to your original risk plan (don’t chase price).

✅ Monitor news events that can affect volatility.

✅ Use alerts instead of watching charts constantly.

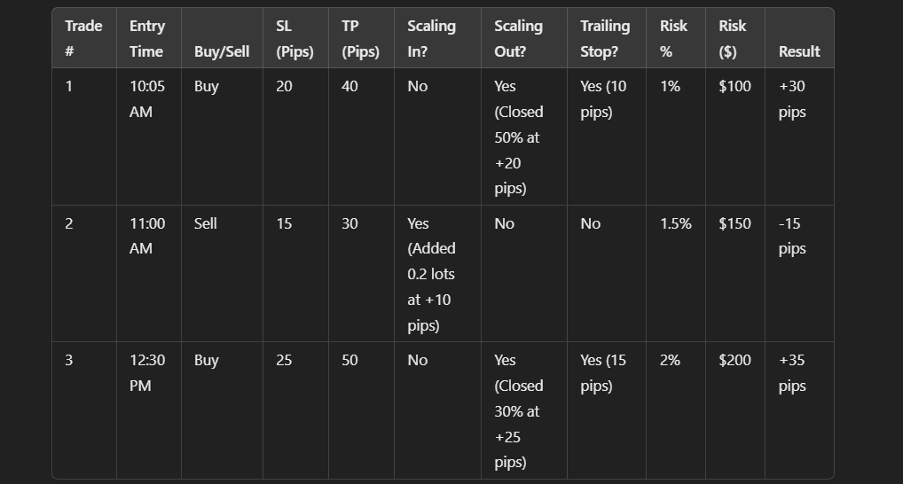

Step 5: Journaling Your Trade Management Strategy

Modify your trade journal to track trade management decisions:

📌 End-of-Session Review:

- Did you scale in or out at the right time?

- Did you set and follow trailing stops?

- Were your adjustments logical, or did you exit emotionally?

Conclusion: What You Should Learn from This Lesson

✅ How to scale in and scale out of positions to maximize gains.

✅ How to use trailing stops to lock in profits.

✅ How to adjust trades in real-time using MT5 tools.

✅ How to journal trade management to improve decision-making.