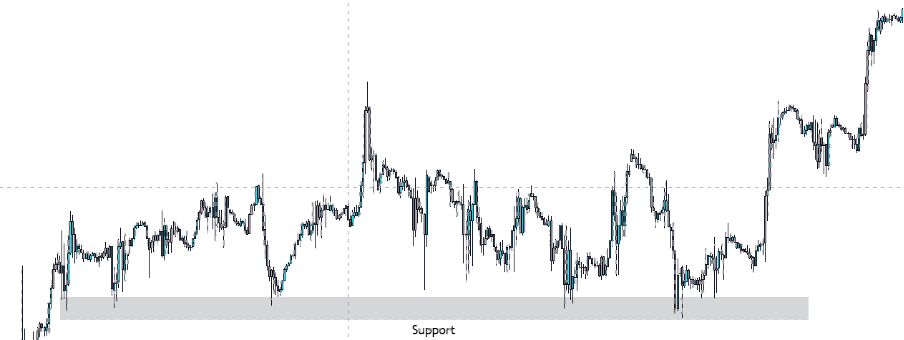

For beginners diving into the world of forex trading, grasping the concept of support and resistance is crucial. These terms describe levels on a chart where currency prices tend to stop and reverse. Here’s a dive into their meaning, why they’re important, and how you can utilize them in your trading strategy.

What is Support?

Support levels are like the floor in a price chart. Imagine a currency pair falling like a ball; support is where this ball bounces back up. Here’s why:

- Buying Pressure: At this level, there’s enough buying interest to push the price up, preventing further decline.

- Psychological Levels: Often, these are round numbers or levels where traders expect a bounce back, leading to a self-fulfilling prophecy.

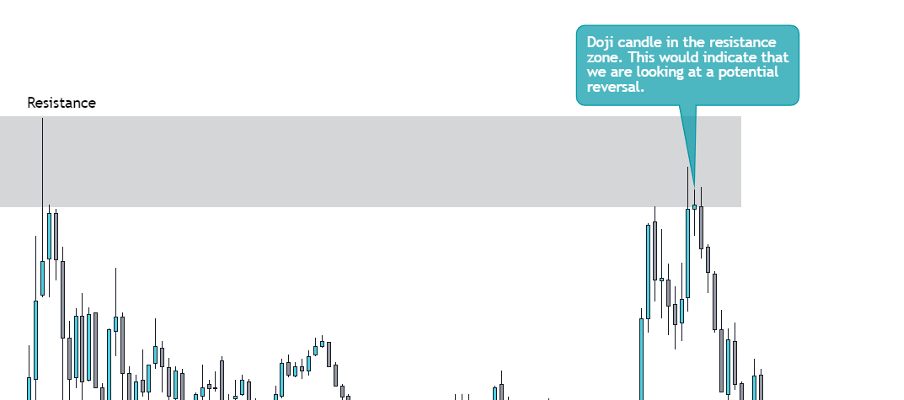

What is Resistance?

Conversely, resistance acts like a ceiling. When the currency price rises, resistance is where it tends to hit a snag, often due to:

- Selling Pressure: Sellers start dominating, believing the price has peaked, pushing it back down.

- Historical Significance: Price points where the currency has reversed before might act as resistance again.

Why Support and Resistance are Important?

- Price Prediction: Knowing where support or resistance might occur helps predict where price movements could pause or reverse.

- Entry and Exit Points: Traders buy near support (expecting a rise) and sell near resistance (anticipating a fall).

- Risk Management: Placing stop-loss orders just below support or above resistance can limit potential losses.

How do you master Support and Resistance?

Here are a few straightforward guidelines to help you significantly improve in identifying key support and resistance areas.

Identify Levels:

- Historical Data: Look at past price actions where the currency pair has reversed. These levels are your initial guide.

- Recent Peaks and Troughs: Use recent highs and lows. If the price has bounced off a level multiple times, it’s significant.

Trendlines:

Dynamic Support/Resistance: Instead of horizontal lines, trendlines can act as dynamic support or resistance, especially in trending markets

Price Action:

- Candlestick Patterns: Look for patterns like doji or hammer at these levels, which might indicate a reversal.

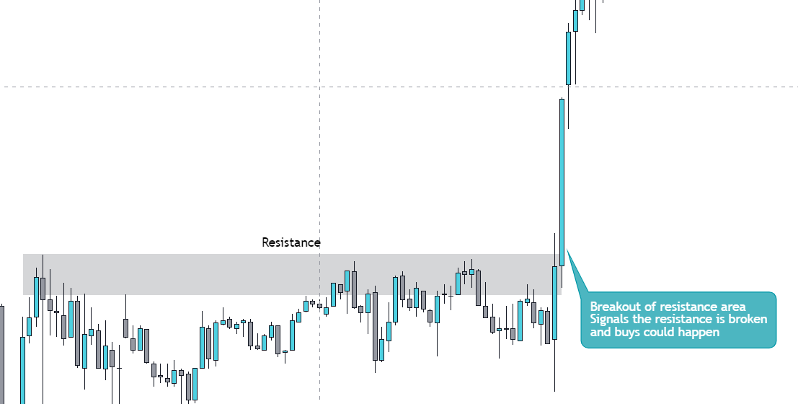

- Breakouts: A price moving through resistance or support with significant volume or momentum might signal a new trend.

Trading Strategies:

Bounce Trading: Buy when the price touches support, expecting it to bounceback. Sell at resistance, anticipating a retreat.

Breakout Trading: If the price breaks through resistance, it might be time to buy, assuming the new level will act as support. Similarly, breaking support might suggest selling or shorting.

Combining with Other Indicators:

- Use indicators like moving averages, Fibonacci retracement levels, or RSI alongside support and resistance for confirmation. If multiple indicators align, it strengthens your trading signal.

Setting Stop-Losses and Take-Profits:

- Place stop-losses just below support or above resistance to manage risk. Take-profit can be set at previous resistance (for long positions) or support (for short positions) levels.

Remember:

- These levels are not absolute; they can sometimes be breached. Markets can also consolidate around these levels, causing false breakouts.

- Support and resistance might not always be exact numbers but zones where price action reacts.

Conclusion

Support and resistance are not just lines on a chart; they are tools that, when used correctly, can enhance your understanding of market dynamics. For beginners, mastering these concepts involves both study and practice. Start by identifying these levels on historical charts, then move to real-time analysis. Remember, while these levels provide a framework, the forex market’s complexity means they should be part of a broader strategy, not the sole basis for trading decisions.