Imagine this: You’ve placed a trade, confident in your analysis. The market moves, but not in your favor. Your position turns red, and that sinking feeling creeps in. What’s happening in your brain at that moment? It turns out, a financial loss triggers a cascade of neural activity—lighting up emotional centers and dimming reward pathways. In this blog post, we’ll explore the neuroscience behind trading losses, peek into what a brain scan might reveal, and share practical insights to help you pilot the emotional rollercoaster of trading.

Table of Contents

What Happens to a Trader’s Brain During a Loss?

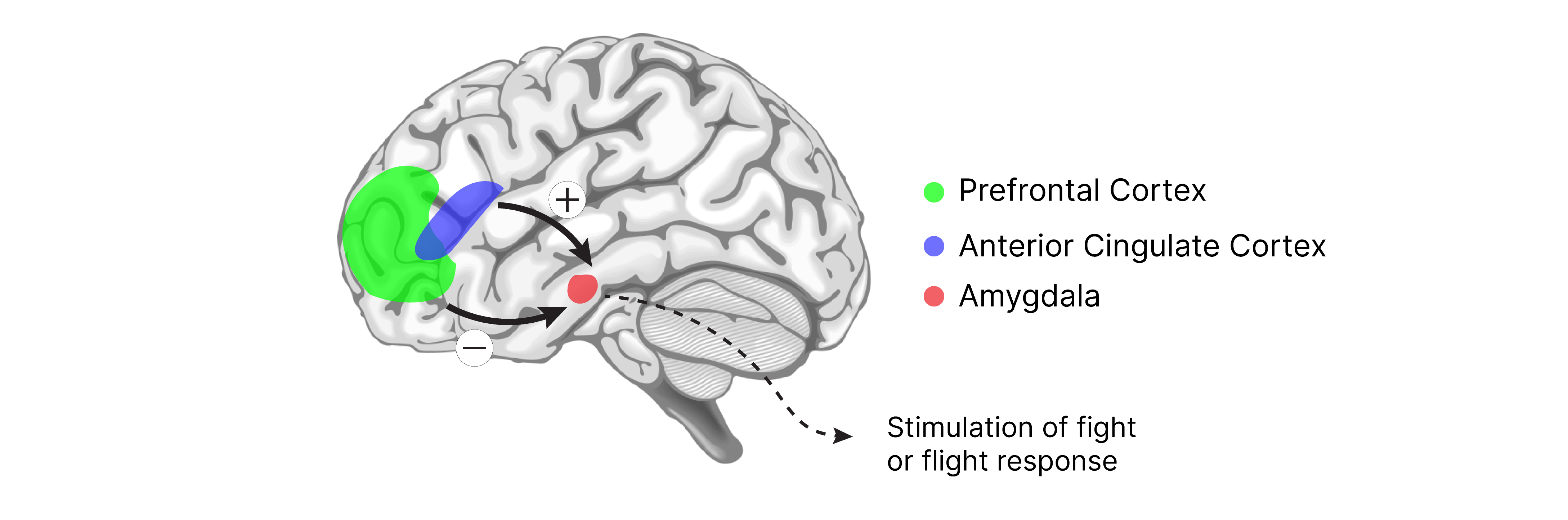

Thanks to tools like functional magnetic resonance imaging (fMRI), researchers have uncovered how our brains react when a trade goes south. Here’s the breakdown of the key players:

- Anterior Insula Activation

The anterior insula is your brain’s alarm system for discomfort and risk. When you lose a trade, this region flares up, signaling anxiety or even a sense of “financial pain.” Studies, like one titled Brain Activity Foreshadows Stock Price Dynamics, show that heightened activity here often leads traders to shy away from risky moves—sometimes too quickly.

- Amygdala Kicks In

Meet the amygdala, your brain’s fear factory. During a loss, it activates, pumping out emotions like anxiety or dread. Research suggests financial setbacks hit this area much like physical threats, amplifying the sting of a losing trade.

- Reward System Takes a Break

The ventral striatum and nucleus accumbens, part of your brain’s reward circuitry, love a good win. But during a loss? They go quiet. This drop in activity can leave you feeling disappointed or unmotivated—a key driver behind the disposition effect, where traders cling to losing positions hoping for a turnaround.

- Anterior Cingulate Cortex (ACC) Steps Up

The ACC is like your brain’s error detector. When a trade flops, it lights up, registering the gap between what you expected (profit!) and what you got (a loss). It’s the nudge that makes you rethink your strategy—or beat yourself up over a bad call.

- Loss Aversion in Action

Ever notice how losses sting more than wins feel good? That’s loss aversion, and it’s wired into your brain. Losses fire up emotional and pain-related circuits (like the insula and ACC) more intensely than gains excite reward areas, often leading to irrational moves like holding a loser too long.

What Would a Brain Scan Show?

Picture an fMRI scan capturing your brain mid-loss. Here’s what you’d see:

- Hot Zones (Red/Yellow):

- Anterior Insula: Glowing as it processes risk and unease.

- Amygdala: Blazing with fear or frustration.

- Anterior Cingulate Cortex (ACC): Bright, signaling the conflict between expectation and reality.

- Cool Zones (Blue/Green):

- Ventral Striatum/Nucleus Accumbens: Dim, reflecting the absence of reward.

Imagine the scan: vibrant red and yellow patches flaring in emotional hubs, while the reward centers sit in muted blues—a stark visual of loss’s emotional toll versus the lack of payoff.

The Science Behind It

Here’s some research that backs this up:

- “Brain Activity Foreshadows Stock Price Dynamics“: This fMRI study found that anterior insula activity spikes when traders face potential losses, hinting at its role in risk aversion.

- “The Neural Basis of the Disposition Effect“: Researchers noted reduced ventral striatum activity during losses, paired with heightened emotional responses, explaining why we struggle to cut losing trades.

- Pain and Loss Studies: Broader neuroscience shows financial losses tap into the same brain areas as physical pain (insula, ACC) and emotional stress (amygdala), making them hit harder.

Neuroscience-Inspired Insights for Traders

Understanding your brain’s wiring can shed light on your trading habits. Here are a few takeaways:

- Losses Hurt Twice as Much: Your brain’s emotional circuits overreact to losses compared to gains—don’t let that skew your decisions.

- The Amygdala’s Panic Button: A bad trade can flip your fear switch, pushing you into reactive mode. Recognize it for what it is.

- Reward System on Pause: When the ventral striatum dims, motivation dips. That’s why sticking to a plan beats chasing feelings.

How to Use This Knowledge

So, what can you do with all this brain science? Here are some practical tips to improve your trading psychology:

- Spot Emotional Triggers: When you feel that gut punch (hello, anterior insula!), take a breath. It’s your brain, not the market, talking.

- Stay Rational: With your reward system offline during a loss, lean on your trading rules—not your mood—to decide your next move.

- Train Your Brain: Research hints that seasoned traders show calmer brain patterns over time. Practice and reflection can dull the emotional edge of losses.

Wrapping Up

When you lose a trade, your brain becomes a battlefield: emotional regions like the anterior insula and amygdala flare up, while reward zones like the ventral striatum fade out. A brain scan would paint this in vivid colors—red-hot emotional hubs clashing with cool, quiet reward areas. By understanding this neuroscience, you can better manage your reactions, stick to your strategy, and grow as a trader.

Disclaimer: ATFunded does not conduct neuroscience research. The information in this blog is based on external studies and provided solely for informational purposes, aligned with our mission to empower traders through funding and education